CryptoWeeksBloomberg is revolutionizing the way we understand the complex world of cryptocurrency. With its weekly feature, Bloomberg offers expert insights that make crypto accessible, whether you’re a seasoned trader or just dipping your toes in the blockchain waters.

This article will explore why CryptoWeeksBloomberg is your ultimate guide to navigating the ever-changing crypto landscape, complete with detailed analysis, regulatory updates, and emerging trends.

Why CryptoWeeksBloomberg Stands Out in Crypto Reporting:

Unlike other platforms, CryptoWeeksBloomberg delivers more than just headlines. Here’s what sets it apart:

Bloomberg’s Financial Expertise

Bloomberg’s team is known for rigorous financial analysis. With CryptoWeeksBloomberg, they leverage that expertise to provide well-researched, in-depth crypto insights.

Real-Time Market Updates

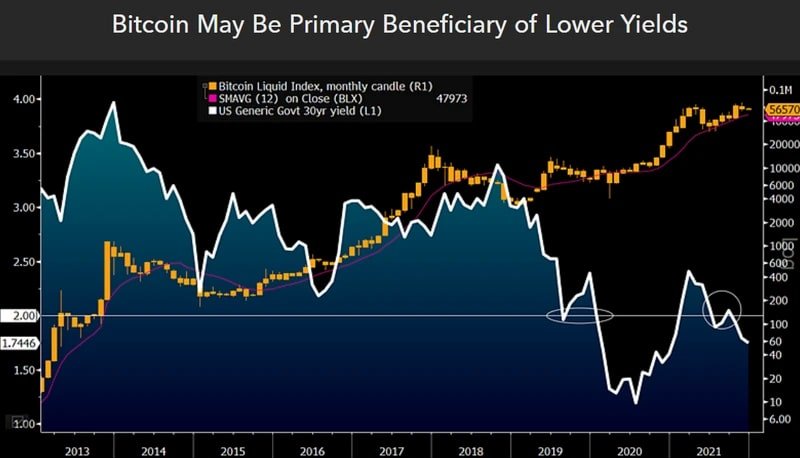

CryptoWeeksBloomberg tracks real-time market movements, giving you updates as they happen. Remember when Bitcoin hit an all-time high of $68,000 in November 2021? Bloomberg was among the first to report it with actionable insights.

Data-Driven Analysis

Instead of vague statements, CryptoWeeksBloomberg backs its reporting with data. For example, they recently analyzed Ethereum’s merge upgrade and how it could reduce energy consumption by 99.95%, making it more sustainable.

Breaking Down Crypto Jargon:

Cryptocurrency can often feel like deciphering a foreign language. Terms like “blockchain,” “DeFi,” and “NFTs” can overwhelm even seasoned investors. But CryptoWeeksBloomberg makes the complex understandable.

How CryptoWeeksBloomberg makes the complex understandable

- Simplified Explanations: CryptoWeeksBloomberg explains complex concepts in easy-to-understand language. For instance, their recent coverage of DeFi (Decentralized Finance) clarified how blockchain technology removes the need for intermediaries in financial transactions.

- Bite-Sized Insights: You’ll grasp concepts like smart contracts and tokenomics in no time through clear analogies and simplified terms.

Market Trends: Real-Time Crypto Insights!

Understanding market trends is crucial for making informed investment decisions. CryptoWeeksBloomberg covers:

Bitcoin and Ethereum Price Trends

Whether Bitcoin’s price fluctuations or Ethereum’s network upgrades, you’ll get comprehensive coverage.

Expert Market Predictions

Bloomberg’s experts go beyond numbers, forecasting how critical factors like institutional investments or regulatory news will impact the market.

Example Market Insights

- Ethereum’s Growth: As of October 2024, Ethereum’s market dominance continues to rise due to its decentralized solid application (dApp) ecosystem. Bloomberg projects that Ethereum’s Layer 2 solutions will boost network scalability, driving further growth.

- Bitcoin Adoption: Bloomberg’s team predicts Bitcoin adoption will accelerate in countries like Argentina, where inflation makes traditional currencies less stable.

Read: The Transformative Power of Joyous Laughter NYT in Our Lives

Navigating Crypto Regulations: A Clear Path Forward!

The global regulatory landscape for crypto is constantly changing, which can be confusing. But CryptoWeeksBloomberg simplifies this by:

Monitoring Global Regulations

Bloomberg monitors all major regulatory shifts, whether the U.S. SEC’s recent lawsuit against Ripple or China’s crackdown on crypto mining.

Impact Analysis

Beyond just reporting, CryptoWeeksBloomberg explains the potential impact of these regulations on your crypto portfolio.

For example, their coverage of the MiCA (Markets in Crypto-Assets) regulation in Europe clearly shows how it might shape the future of digital currencies in the EU.

Innovation Spotlight: What’s Next in Crypto?

Cryptocurrency is an ever-evolving space, with groundbreaking technologies and innovations emerging regularly.

Keeping up with these advancements can be challenging, but CryptoWeeksBloomberg focuses on what’s next in the crypto world.

They dive into the latest trends reshaping industries and creating new investor opportunities. Below are some of the critical innovations they highlight:

NFTs (Non-Fungible Tokens)

NFTs have exploded in popularity, initially gaining attention through digital art sales, but their potential stretches far beyond that.

CryptoWeeksBloomberg delves into how NFTs are revolutionizing the art world and industries like gaming, entertainment, and real estate. For example:

- Gaming: NFTs allow players to truly own in-game assets (such as skins, characters, or land) and even sell or trade them on decentralized marketplaces, creating a new economy within gaming.

- Real Estate: NFTs are emerging to tokenize real estate properties, allowing for fractional ownership and smoother cross-border transactions.

Bloomberg’s coverage explains these shifts in simple terms, giving readers a sense of how NFTs are becoming a cornerstone of digital ownership.

It helps readers understand how these tokens can verify and transfer ownership in a way that’s more secure, efficient, and transparent than traditional systems.

Defi Protocols

Decentralized Finance (DeFi) is one of the most disruptive trends in the world of finance, and CryptoWeeksBloomberg consistently covers the most promising DeFi protocols and innovations.

These projects aim to replace traditional banking services like loans, savings accounts, and trading with decentralized alternatives, removing middlemen like banks and brokers. Notable protocols like:

- Aave: It is the decentralized lending platform where users can borrow or lend crypto without needing a bank. Bloomberg often explains how Aave’s liquidity pools work and why its governance system (run by token holders) makes it unique.

- Uniswap: A decentralized exchange (DEX) that allows users to trade crypto assets directly from their wallets without relying on centralized exchanges like Coinbase. Bloomberg sheds light on how Uniswap uses an automated market maker (AMM) system and how it’s paving the way for permissionless trading.

CryptoWeeksBloomberg explains the implications of DeFi innovations in a way that helps even non-technical readers grasp how they can reshape financial markets.

These protocols are not just trends they are fundamental to the future of a decentralized economy, and Bloomberg tracks their growth, risks, and adoption rates.

Latest Innovation Examples

- Solana’s Surge: Recently, Solana has gained attention for its ultra-fast transaction speeds and lower fees than Ethereum. Bloomberg’s coverage explained how Solana’s proof-of-history (PoH) mechanism could disrupt the bright contract space.

Exclusive Interviews with Crypto Experts

Want insights from industry leaders? CryptoWeeksBloomberg offers exclusive interviews with crypto pioneers, blockchain developers, and top investors, allowing you to tap into expert knowledge that’s hard to find elsewhere.

Key Interviews

- Vitalik Buterin (Ethereum Founder): In a recent interview, Buterin discussed Ethereum’s transition to proof-of-stake (PoS) and its implications for the future of decentralized networks.

- Michael Saylor (CEO of MicroStrategy): Saylor, a staunch Bitcoin advocate, shared his long-term vision for Bitcoin as a store of value, likening it to “digital gold.”

The Global Perspective on Crypto:

Crypto is a global phenomenon, and CryptoWeeksBloomberg provides comprehensive coverage from crypto hotspots around the world:

El Salvador’s Bitcoin Adoption

Bloomberg’s team was among the first to report on El Salvador’s historic decision to adopt Bitcoin as legal tender, analyzing its effects on the country’s economy and the broader crypto market.

Switzerland’s Crypto Valley

With blockchain startups flourishing in Zug, CryptoWeeksBloomberg showcases the innovative projects emerging from Switzerland’s crypto-friendly ecosystem.

Read: Who Is Jann Mardenborough Wife? You Need to Know About Her

Conclusion:

In a fast-moving and often confusing crypto world, CryptoWeeksBloomberg is your reliable guide. With its data-backed analysis, simplified explanations, and expert interviews, you’re not just staying informed but ahead of the curve.

Whether you’re a crypto newbie or a blockchain veteran, CryptoWeeksBloomberg is your weekly ticket to understanding the future of digital finance.

FAQs:

What types of cryptocurrencies does CryptoWeeksBloomberg cover?

CryptoWeeksBloomberg covers a wide range of cryptocurrencies, including popular ones like Bitcoin, Ethereum, Solana, and emerging altcoins. They also dive into sectors like DeFi tokens, stablecoins, and NFTs, ensuring you get comprehensive coverage.

How can CryptoWeeksBloomberg help me make investment decisions?

While it doesn’t offer direct investment advice, CryptoWeeksBloomberg provides in-depth market analysis, regulatory updates, and expert opinions. This helps you make well-informed decisions based on reliable, data-backed insights.

Does CryptoWeeksBloomberg provide crypto security tips?

Yes, CryptoWeeksBloomberg often discusses best practices for securing crypto assets, including using hardware wallets, two-factor authentication, and staying safe from phishing attacks.

What sectors beyond finance does CryptoWeeksBloomberg focus on?

Aside from finance, CryptoWeeksBloomberg explores how blockchain technology disrupts industries like healthcare, real estate, gaming, and supply chain management, offering a broader perspective on crypto’s impact.

How accurate are CryptoWeeksBloomberg’s predictions?

Bloomberg relies on experienced financial analysts and data to make their forecasts. While no prediction is 100% accurate, their insights are based on historical trends and market behavior, offering a reasonable outlook on potential movements.

Can I find user reviews or opinions on CryptoWeeksBloomberg?

CryptoWeeksBloomberg occasionally features expert opinions and interviews with industry leaders, but it does not focus on user reviews. For community-driven reviews, you may need to check other forums or platforms.

How does CryptoWeeksBloomberg keep up with fast-moving crypto news?

Bloomberg’s global network of reporters and analysts ensures that CryptoWeeksBloomberg stays on top of breaking news and market shifts, providing real-time updates and reports as developments unfold.

Does CryptoWeeksBloomberg cover crypto scams and frauds?

Yes, they frequently report on high-profile crypto scams, frauds, and phishing attacks, offering insights on how to avoid falling victim to these schemes and highlighting regulatory actions against such activities.

How can CryptoWeeksBloomberg help me understand crypto taxes?

CryptoWeeksBloomberg often covers regulatory developments, including how various countries approach crypto taxation. Their articles explain tax obligations for crypto transactions, profits, and losses in different jurisdictions.

Does CryptoWeeksBloomberg cover the institutional adoption of crypto?

It regularly reports on how institutional players like banks, hedge funds, and corporations are adopting cryptocurrencies. They provide an analysis on how this impacts the broader market and individual investors.

Read: